|

|||||

|

|

| 计及电价不确定性和损耗成本的储能竞价策略 | |

| 作者姓名: | 李柯江 宋天昊 韩肖清 张东霞 |

| 作者单位: | 太原理工大学电气与动力工程学院,山西省太原市 030024 |

| 基金项目: | 国家自然科学基金-山西煤基低碳联合基金项目(U1910216)。 |

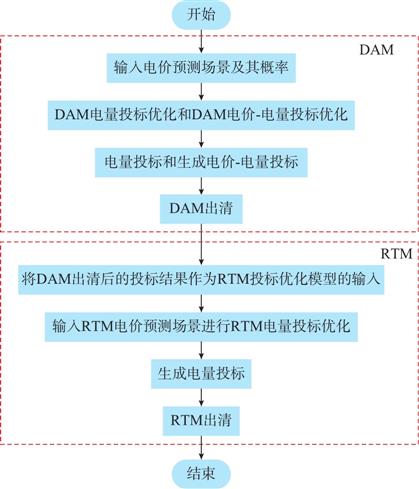

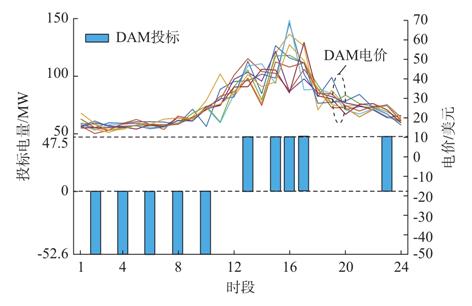

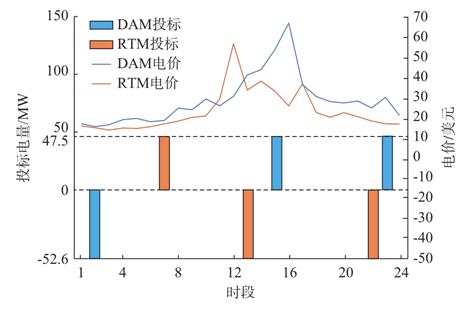

| 摘 要: |  储能是促进新能源消纳、提高电力系统稳定性和灵活性的有效措施。然而储能参与电力市场的策略极其复杂,现已成为实现储能商业化应用的关键问题之一。文中提出储能在日前和实时市场价格不确定环境下考虑循环损耗成本的最优竞价策略。  为权衡储能多次循环增加的售电利润和损耗成本,在制定储能竞价策略时,将其循环损耗成本的影响计及在内,并充分考虑电池充、放电深度对循环损耗成本和利润的影响;在日前市场中建立电价-电量投标模型,对电价和电量同时进行投标以充分考虑电价不确定性;在实时市场中建立电量投标模型对日前市场投标进行弥补修正,使竞价策略更加合理与优化。算例验证了所提储能竞价策略的有效性,并说明所建模型可以确定最优电池充、放电深度。  |

| 关 键 词: | 储能 电力市场 投标策略 电价不确定性 循环损耗 |

| 收稿时间: | 2020-02-19 |

| 修稿时间: | 2020-05-19 |

| 本文献已被 CNKI 等数据库收录! | |

| 点击此处可从《电力系统自动化》浏览原始摘要信息 | |

| 点击此处可从《电力系统自动化》下载全文 | |